As interest rates stabilize and traditional rental models face more volatility, a growing number of investors are turning to passive multifamily syndications—especially in markets like Tyler, Texas. With dependable rent rolls, lower volatility, and increasing regional demand for workforce housing, the shift is well-founded.

At Cintra Realty, we’re seeing investor profiles change. Many high-income professionals, early retirees, and small business owners are reallocating funds away from individual rentals and into managed syndication deals. Here's why:

Market Conditions Support Multifamily Scalability

Tyler has held up better than many metro areas in 2025. While some parts of the U.S. are facing slowing rent growth or increasing vacancies, Class B and C properties in Tyler’s submarkets remain well-occupied with waiting lists in some locations.

The city’s medical infrastructure and educational institutions create constant rental demand, particularly among mid-income earners who rent long-term. That stability makes multifamily investment—when professionally managed—especially appealing.

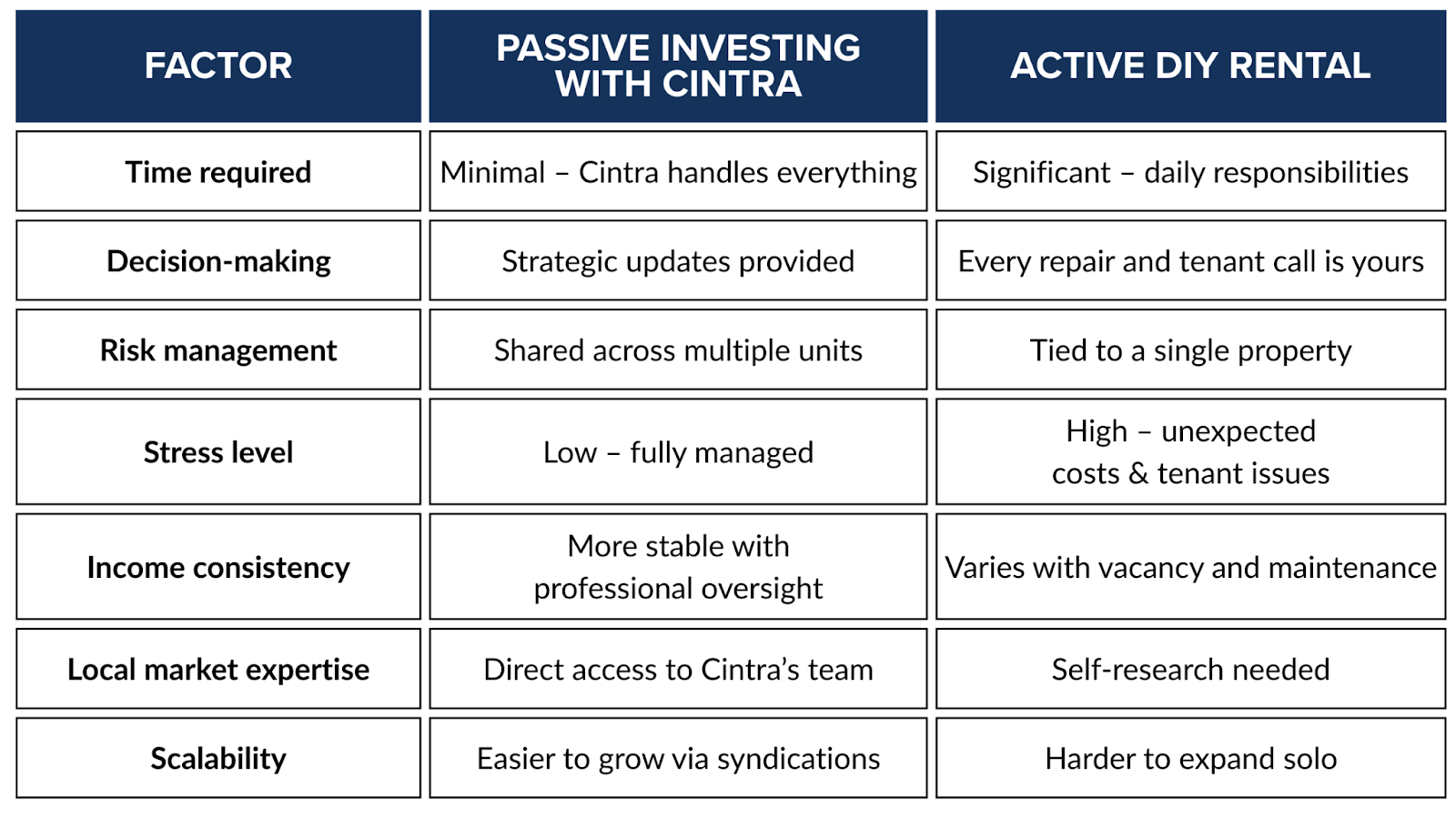

Passive vs. Active Investing: A Practical Comparison

Here’s how the economics typically break down for a passive investor in a Cintra-managed deal versus someone operating a single-family rental independently:

How Cintra Structures Its Syndications

Cintra’s syndications are structured to minimize investor friction:

Preferred Returns: Investors typically receive 6–8% preferred returns before profit splits.

Quarterly Distributions: Regular, documented cash flow updates.

Full Reporting Suite: Access to dashboards with unit-by-unit financials, occupancy stats, and CapEx progress.

Defined Exit Strategy: Most projects aim for a 5–7 year hold with targeted sale or refinance at year 3–5.

The team handles acquisition, renovation, tenanting, rent collections, compliance, and eventual disposition—without leaning on investor participation.

Who This Serves Best

Passive syndications suit those who have capital but limited time or tolerance for management pressure. We’re seeing higher participation from:

Dual-income households

Physicians and legal professionals

Out-of-state investors seeking geographic diversification

Retirees looking for stable monthly income without added risk

Conclusion

Multifamily syndications in Tyler offer competitive returns, managed risk, and hands-off administration—backed by a local team with deep operational history. Cintra Realty’s syndications make use of regional data, market relationships, and proven processes to protect capital and provide consistent yield.

Would you like to receive upcoming syndication opportunities or a breakdown of current returns by asset class? Reach out to us!